Since FY2001, the University of Arizona has established flat fringe benefit rates for each of the major employee groups at the campus. These rates have and will be reviewed and approved annually by the Cost Allocation Services. Fringe benefit expenses are determined by applying the appropriate percentage based on employee category to actual salary expense.

Included Benefits

- Full-Benefit* - Health, Dental, Long-Term Disability, Retirement, Unemployment Compensation, Qualified Tuition Remission - Employee, Termination Leave, and Employee Wellness is charged on all eligible employees regardless of participation.

- Faculty Ancillary* - Health, Dental, Long-Term Disability, Retirement, Termination Leave, and Employee Wellness is charged on all eligible employees regardless of participation. Employee is generally on a temporary or short-term employment contract. There will be some employees who may reach benefit eligibility. Also included in this category are Postdoctoral Research Associates I-V who are offered benefits with the exception of retirement.

- Classified Temporary/Part-Time* - An employee hired at an .49 FTE or below and/or on a temporary basis. These employees are not eligible to participate in employee benefit or insurance plans.

- Graduate Assistants* - A contracted part-time employee in teaching, research, or outreach.

- Student Employees* - A part-time employee who is concurrently enrolled at the University of Arizona with the primary goal of pursuing their education. These employees are not eligible to participate in employee benefit or insurance plans.

- Tuition Remission - The tuition remission portion for Graduate Assistants will now be a direct charge to all departmental accounts.

*FICA, Workers Compensation, and Liability Insurance is charged on all employee categories.

Calculation Method

The University of Arizona uses multiple fringe benefit rates developed under the requirements of Office of Management and Budget (OMB) Uniform Guidance.

A fringe benefit rate for each benefit category is calculated by the development of a pool of fringe benefits costs (the numerator) and of a salary and wage base (the denominator). The pool consists of costs for the benefits provided to a particular category of employees. When the pool is divided by the base applicable to that category of employees, a rate results; this rate represents the percentage that must be added to employees’ salary and wage dollars.

A federal formula is required to take the above mentioned information and using a “look-back” provision to calculate an on-going rate. The fringe benefit rate for each benefit group will be reviewed annually to ensure an accurate allocation. Any over or under recovery of actual fringe benefit costs will be adjusted in the next rate calculation, utilizing the prescribed federal formula.

Reasons for Charging Fringe Rates

Overall, this methodology for calculating and charging fringe benefits is considered a best practice at leading research institutions. Several large research universities have already adopted this practice including, Georgia Institute of Technology, State University of New York, Emory University, and University of Florida.

This fringe methodology facilitates planning, budgeting, and other tasks in the ongoing operations of the campus. It simplifies and improves the preparation, administration, and monitoring of budgets and accounting for fringe benefit expenditures. It also provides for consistent accumulation and allocation of fringe benefits expenses to all functional activities as required by Cost Accounting Standards 501 and 502. In addition, it allows the university the opportunity to recover fringe benefit costs from all funding sources.

Effective Dates | Changes | Due Dates

The University is awarded rates by fiscal year (FY). For example, FY2019 rates are effective July 1, 2018 - June 30, 2019.

The University will have new fringe benefits rates each fiscal year. Fringe benefit rates for each employee group will be reviewed annually to ensure an accurate allocation. Any over or under recovery of actual fringe benefit costs will be adjusted in the next rate calculation. Also, rates cannot be adjusted mid-year. Rates have to be approved by our cognizant agency (formerly DHHS, now CAS). CAS will only approve rates set forth in a specific proposal format. This process is completed annually. Any unexpected benefit changes that were not considered in the prior proposal will be utilized to estimate the next year’s proposal.

Rates are due December 31 of each year for the following fiscal year. Extensions can be requested, but it is imperative for campus budgeting that rates are available as soon as possible.

Waivers

ERE cannot be waived, regardless of the funding source, having employees innately incur costs to the University. In order to proportionately collect these costs each employee is charged the ERE rate.

Frequently Asked Questions

- Click Dashboards.

- Select General – Labor Ledger.

- Click on the Payroll Expenditure tab.

- Remove the Organization Code.

- Enter the Employee ID and click Apply to view all compensation for the employee.

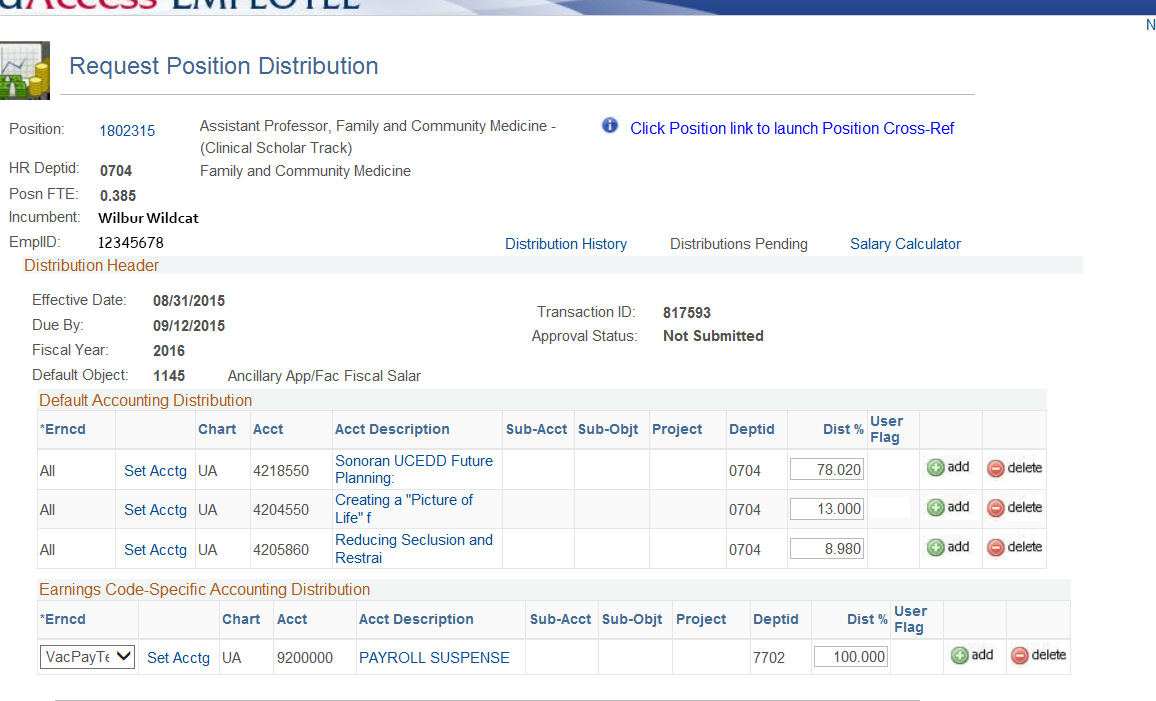

Yes, vacation payouts are now paid out of the Payroll Suspense account (9200000) which became part of the University's ERE rates (Termination Leave). When an employee is terminated and receives their vacation payout, the Payroll Suspense account will be added to their position distribution for the payout. When the position is vacated, the Position Distribution funding will need to be deleted. If the funding is not deleted, future employees in this position will be funded from the wrong account. To delete the funding, click the red "delete" icon to the right of the accounting line.

- In February 2013, The Tuition Benefits Committee provided a recommendation that tuition remission be a direct charge and not applied as an ERE component. They also felt direct charge would balance both University financial needs and the financial constraints of individual programs to strengthen graduate education at the University. This change is made with the understanding that:

- Graduate tuition benefit is essential to recruit and retain the best graduate students

- Tuition benefit is fairly distributed

- RCM philosophy of budgeting, the funding should be transparent

- Faculty and Graduate Students will know the full costs of tuition benefits

- The amount of subsidy from the institution will be known

- The ERE Executive Finance Committee evaluated this recommendation and determined a method for enacting the change.

- For additional questions and information regarding Tuition Remission, please refer to the Graduate College Graduate Assistant/Associate Manual.

- Direct Bill Remission began at the start of FY 2016.

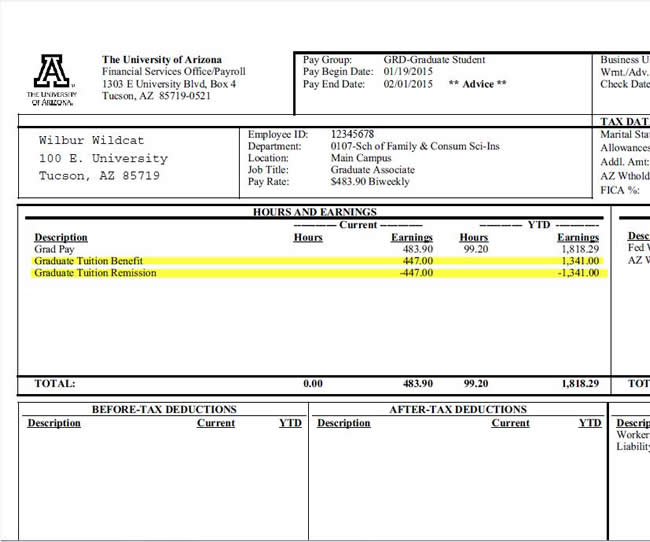

See image below. (The highlighted lines have been added. All other information will remain the same.)

The following have been created to address this issue:

Scenario 1: Awarded and/or budgeted prior to 7/1/2015

If your grant/contact was awarded or budgeted prior to 7/1/2015 and was budgeted under the ERE rates, you will need to pay the difference from another budgeted category or a departmental account. Under RCM the tuition received from the GTR will be awarded tax free to state and local funds only. All other restricted funds (sponsored, auxiliary, agency, etc.) will be taxed. The following are two examples:

Budget does not cover cost of tuition

| Budgeted: | ||

| Salary | $20,000 | |

| Grad Asst ERE 13.3% | $2,660 | |

| Tuition Remission 50% | $10,000 | |

| Actuals: | ||

| Direct Bill of TR | $11,000 | |

| Variance | ($1,000) | - This portion will need to be paid by grant from another category or from another departmental account |

Cost of tuition was over budgeted

| Budgeted: | ||

| Salary | $30,000 | |

| Grad Asst ERE 13.3% | $3,990 | |

| Tuition Remission 50% | $15,000 | |

| Actuals: | ||

| Direct Bill of TR | $11,000 | |

| Variance | $4,000 | - This portion will need to be re-budgeted in grant. |

Scenario 2: New budget as of 7/1/2015

If your grant/contact is in the process of being awarded or budgeted after 7/1/2015 it would no longer fall under the ERE rates, the actual tuition costs can be budgeted. The following is an example:

New FY2016 budget process

| Budgeted: | ||

| Salary | $30,000 | |

| Grad Asst ERE 13.3% | $3,990 | |

| Tuition Remission 50% | $11,000 | |

| Actuals: | ||

| Direct Bill of TR | $11,000 | |

| Variance | $0 | - No variance for tuition remission. |