The University of Arizona has a master service agreement with Eventbrite, an event management application. Eventbrite is an easy-to-use application that offers a suite of services to facilitate online meeting promotion, registration, payment collection, and reporting. The services are based around a series of self-explanatory templates that allow a department to develop a customized meeting registration site. A help portal, online and offline resources, and live training are all available from Eventbrite.

To learn more about the many capabilities of the event manager applications, visit the Eventbrite website.

Go to Lynx

Establishing an Account

To use this service, contact FNSV-Banking-And-Merchant-Services@arizona.edu to request an account. You will be provided a sub-organization under the campus master organization. The department will manage the sub-organization.

- All event or department personnel that have access to payment card information must view or attend Payment Card Security Awareness Training. Keep the certification in your department records.

- All accounting reports and reconciling of the event must be reviewed weekly and records retained according to the University retention period.

Cost

- The current rates are 2.5% + $.99 per registration and a flat rate of 3.00% for credit card gateway fee

- There is no set up fee

- If the event is free, no registration charges are assessed

Customer Registration Fees

- The registration fees are collected when the attendee registers. For simplicity, we suggest you include the registration fee in the event/conference registration.

- You will be sent a net (registration minus registration fee) amount after the event unless arranged otherwise. Refer to Accounting Treatment below.

- Refer to Tax Services for any tax implications and the University's taxpayer ID.

- All registration payments from Eventbrite and other sources must be deposited into a UAccess Financials account. For payout method of direct deposit on Eventbrite, please contact FNSV-Banking-And-Merchant-Services@arizona.edu for banking information including account and routing number. Funds will need to be claimed by the department via electronic payment claim.

- For UA Foundation non-philanthropic events, (e.g., conferences, workshops, and graduation celebrations) registration fees do not include a charitable donation; therefore, there is no need to capture them in the Lynx donor/constituent records system.

Accounting Treatment

- When claiming funds via electronic payment claim or depositing a check via a Cash Receipt, gross revenue and all Eventbrite fees should be recorded in compliance with Generally Accepted Accounting Principles (GAAP).

- Gross Revenue is the total price of the tickets or registration fees for the event before any expenses are deducted.

- Net Revenue is the revenue remaining after deducting expenses such as payment processing and service fees from the gross revenue. This provides a more accurate view of the actual earnings for the event.

- Calculation: Net Revenue = Gross Revenue - Total Eventbrite Expenses

- Example of claiming funds via electronic payment claim:

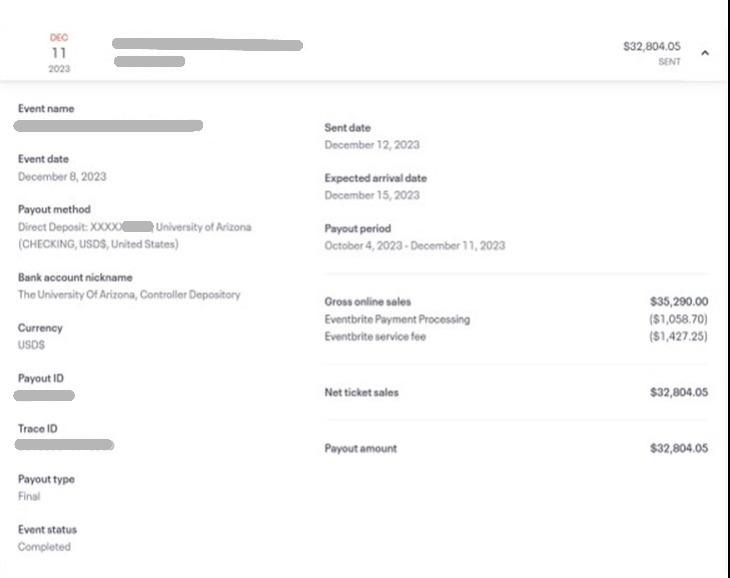

- The total ticket price for the conference event is $35,290.00, generating a gross revenue of $35,290.00. The gross revenue of $35,290.00 should be recorded to Object Code 0710 Seminars and Conferences.

- The Eventbrite payment processing and service fees total $2,485.95. These fees should be recorded to Object Code 3140 Financial.

- After deducting $2,485.95 from the gross revenue, the net revenue is $32,804.05, which is available to be claimed or deposited.

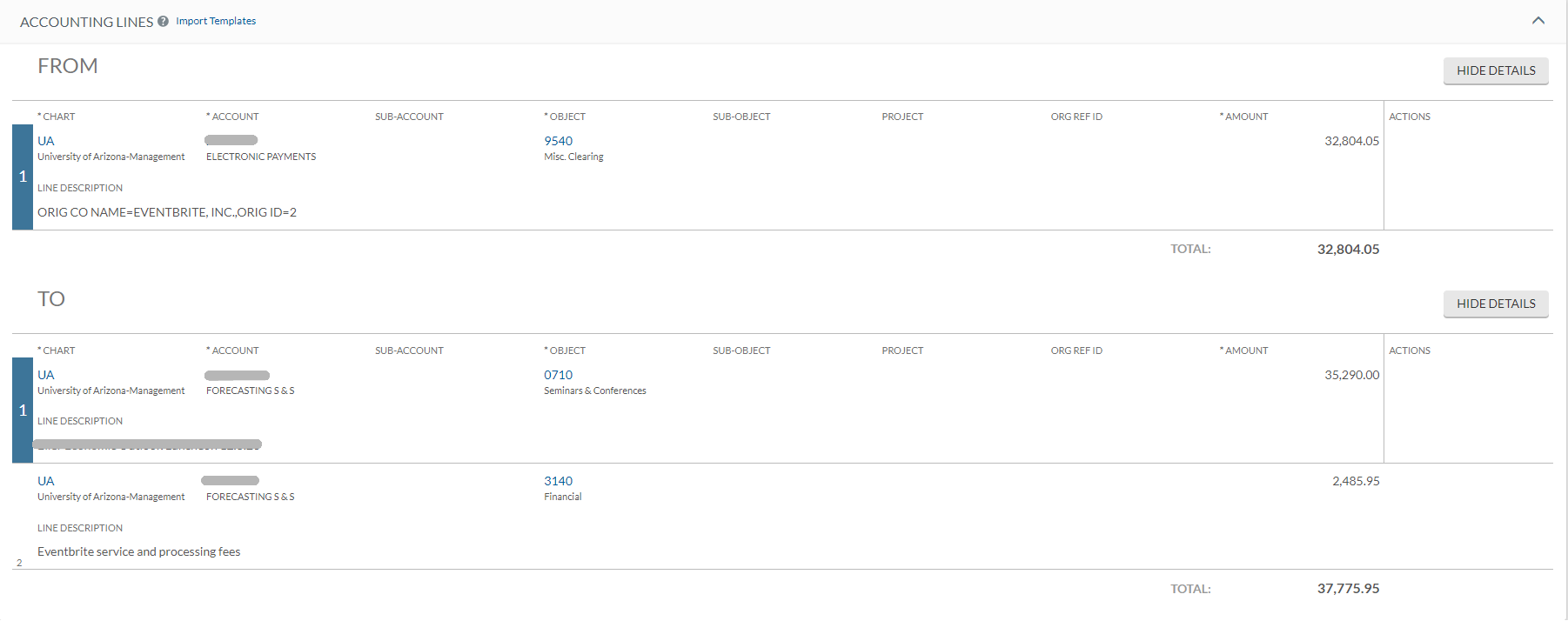

- To appropriately record the gross revenue and the related fees, add the accounting lines to the To section of the Distribution of Income and Expense (DI) as shown below:

- Supporting documentation from Eventbrite must be attached to the document that reflects the gross revenue, Eventbrite fees, and net revenue. See below for example.

- If you have questions regarding the recording of these transactions, contact your Fund Accountant.

If Collecting Payments at Events...

- Online payments may only be collected via a secure laptop which can only access Eventbrite.

At no time may a department staff member enter credit card information through the Eventbrite Administration Registration function, nor on a University-owned desktop computer, tablet, or smartphone. Contact your IT department to discuss the laptop security process. - Analog point of sale terminals, cellular point of sale terminals, or phone authorization accounts are available for rental. Contact us to reserve as soon as possible, as these are rented often.

- Check and cash payments are acceptable. Please see Cash Handling Policy 8.10 for guidance.

Expense Guidelines

- Expenses for events must be appropriate and reasonable, and a clear business purpose must be provided for all uses of University funds. Refer to the Business Purpose Guide and Reasonable Expense Guide for more information.

- Refer to the University Catering & Alcohol Service information if you are planning to provide these services for your event.

Other Event Management Solutions

The selection of Eventbrite is a campus agreement made through the University procurement process. Eventbrite was selected as a result of price and acceptance of our State statute agreement language. Other Event management services would not agree to the mandatory agreement language. Be aware that a department must discuss any vendor agreements through Financial Services Purchasing.