Using a Distribution of Income and Expense (DI) document to reverse use tax for a previous fiscal year:

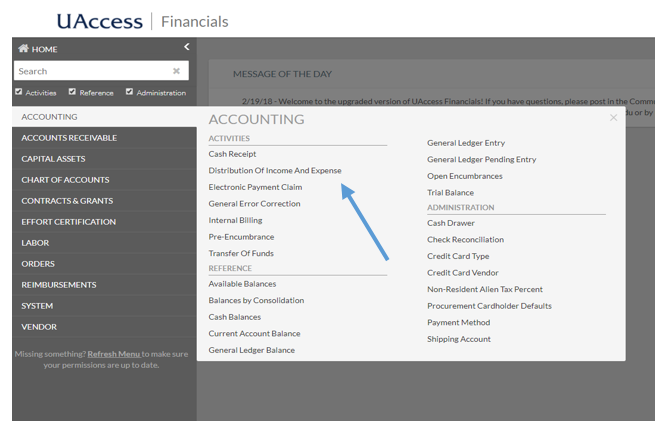

- Log in to UAccess Financials and log in.

- Click on Accounting > Distribution of Income and Expense

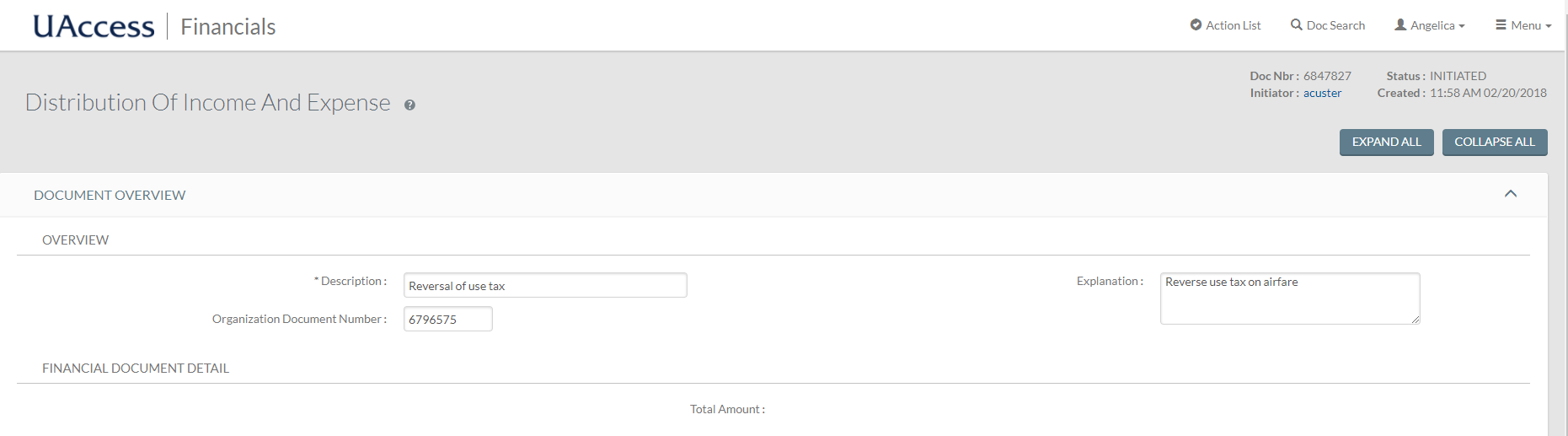

- On the newly opened DI screen, complete the required fields:

- Description - “Reversal of use tax”

- Organization Document Number - Enter the original PCDO e-doc #

- Explanation - Brief explanation why the correction is needed. Use tax reversals are justified when the original purchase meets any of the following criteria:

- It is tax-exempt based on intended use and supported by an exemption statement,

- It is not considered tangible personal property,

- It was not used or consumed in the State of Arizona, or

- Sales or other excise tax was already paid to the vendor, as verified by an itemized invoice or receipt.

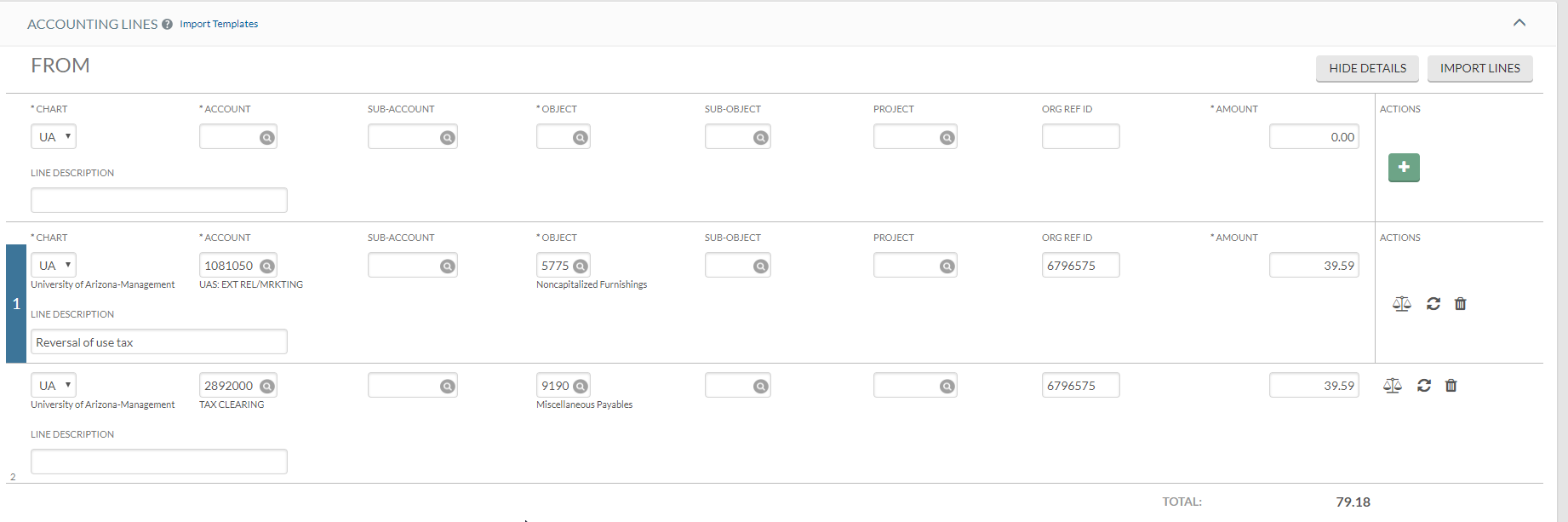

- Go to the Accounting Lines tab to create entries to reduce the use tax expense and use tax liability

- On the first FROM line, add information from the original PCDO:

- Chart Code - UA

- Enter Account and Object Code in which the expense was charged, including Sub-Account and/or Sub-Object Code if applicable

- ORG REF ID - the original PCDO e-doc #

- Enter amount of use tax charged in the Amount field

- Line description - “Reversal of use tax”

- Click + (Add) button

- on a new FROM Line, add:

- Chart Code - UA

- Enter Tax Clearing Account 2892000 and Miscellaneous Payables Object Code 9190

- ORG REF ID - the original PCDO e-doc #

- Enter amount of use tax charged in the Amount field

- Line description - “Reversal of use tax”

- Click + (Add) button

- Add any additional relevant information on the Notes and Attachments tab. If an invoice is not available with the original e-doc, a copy should be attached.

- Click Save

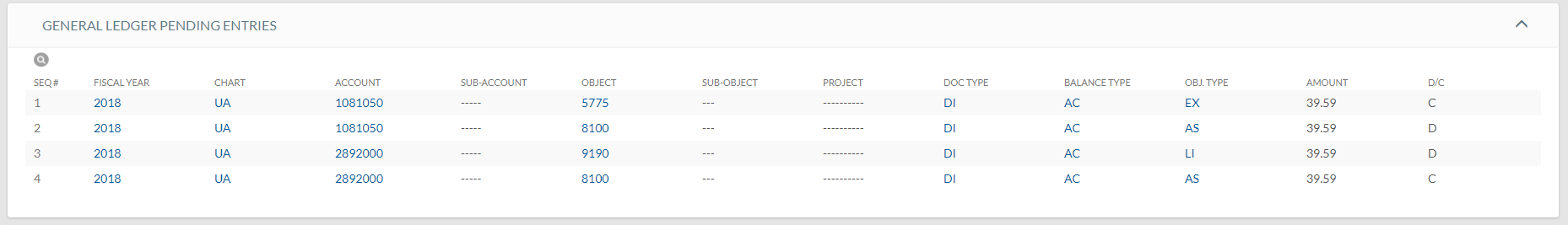

- Review General Ledger Pending Entries to verify credits and debits are posting to the correct accounts and object codes.

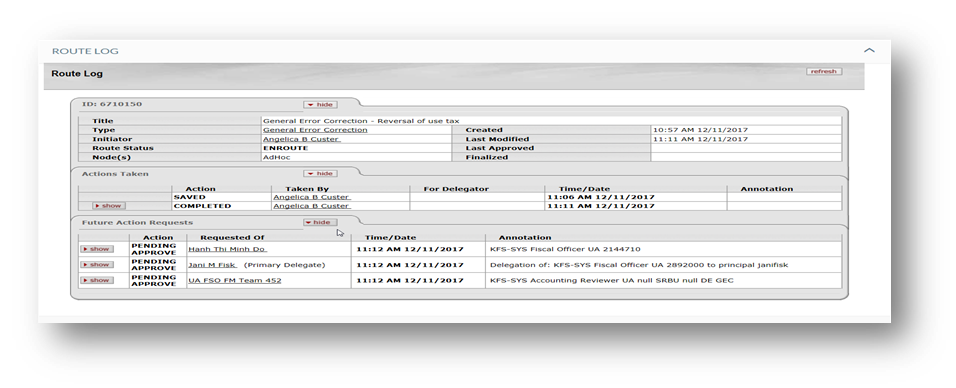

- Click on the Route Log to view the Future Action Requests and next steps.

- Click Submit to process the DI.