Using a DI document to:

- Assess use tax for the current or a previous fiscal year

- Reverse use tax from a credit received in a previous fiscal year

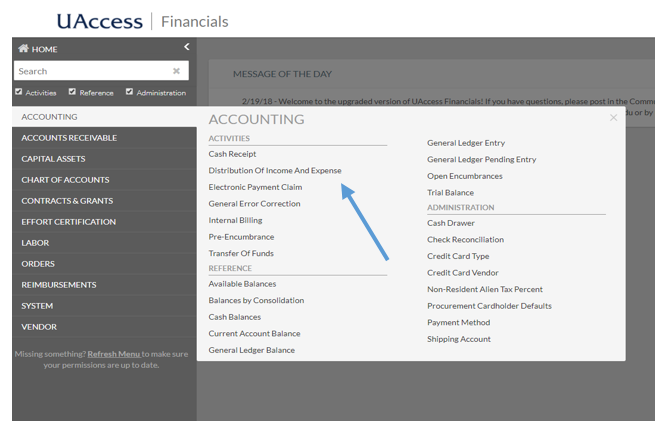

- Go to UAccess Financials and log in

- Click on Accounting > Distribution of Income and Expense

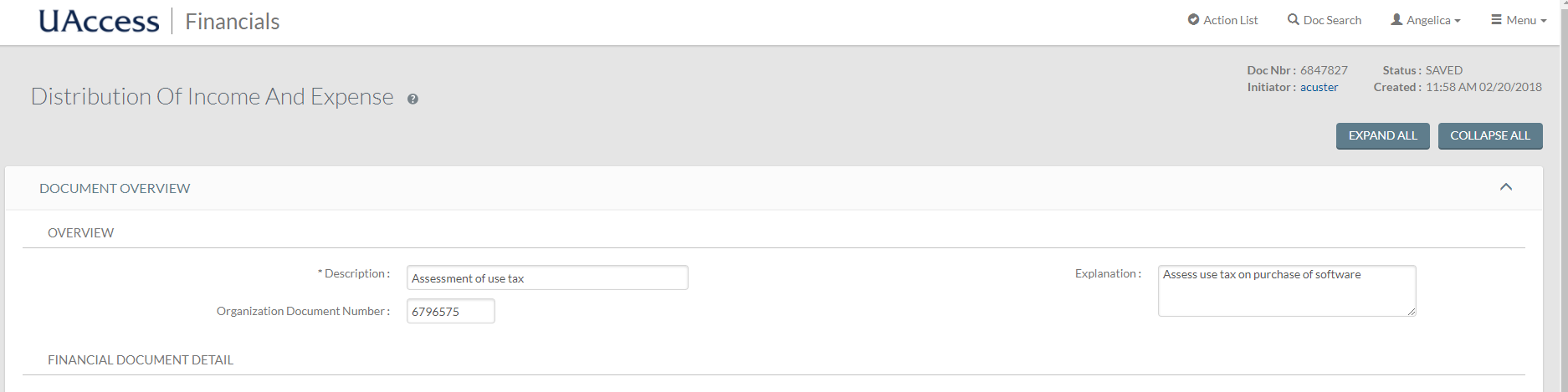

- On the newly opened DI screen, complete the required fields:

- Description - “Assessment (or reversal of credit) of use tax”

- Organization Document Number - Enter the original PCDO e-doc #

- Explanation - Brief explanation why the correction is needed

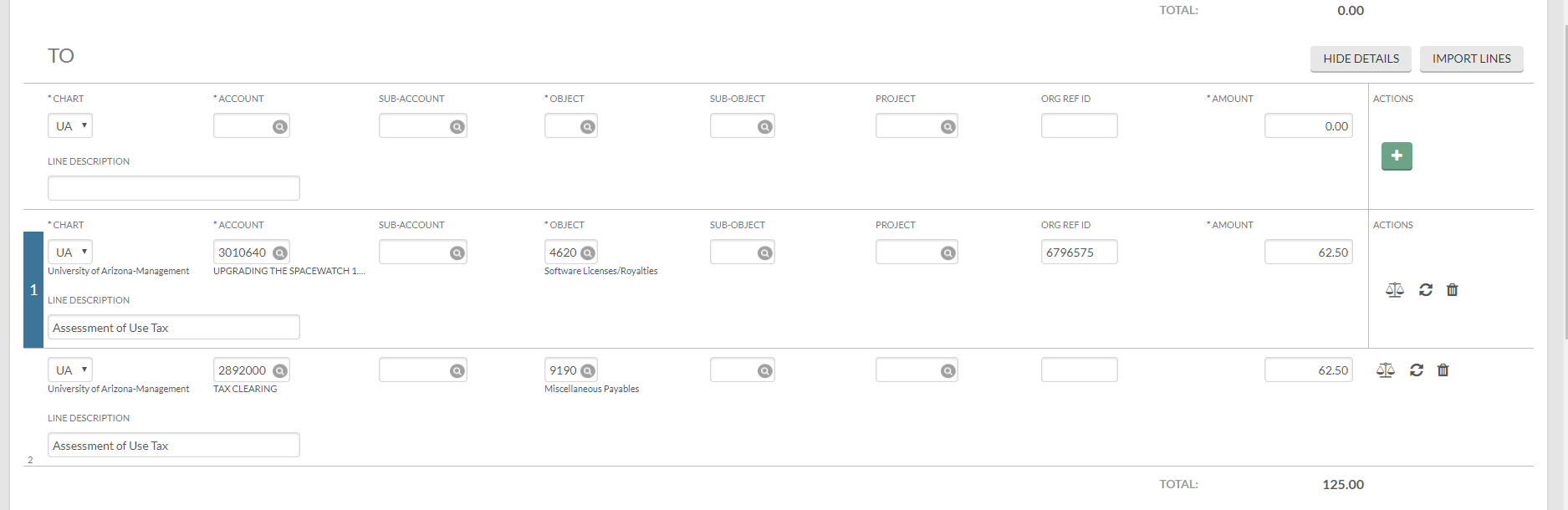

- Go to the Accounting Lines tab to create entries to increase the use tax expense and use tax liability

- On the first TO line, add information from the original PCDO

- Chart Code - UA

- Enter Account and Object Code in which the original expense was charged, including Sub-Account and/or Sub-Object Code if applicable

- ORG REF ID - the original PCDO e-doc #

- Enter amount of use tax to be assessed in the Amount field

- Line description - “Assessment (or reversal of credit) of use tax”

- Click the + (Add) button

- On a new TO line, add:

- Chart Code - UA

- Enter Tax Clearing Account 2892000 and Miscellaneous Payables Object Code 9190

- ORG REF ID - the original PCDO e-doc #

- Enter amount of use tax to be assessed in the Amount field

- Line description - “Assessment (or reversal of credit) of use tax”

- Click the + (Add) button

- Add any additional relevant information on the Notes and Attachments tab and click Save.

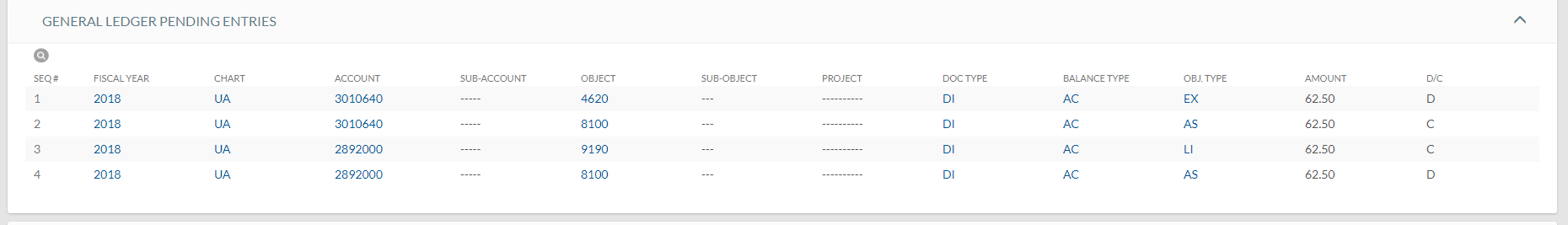

- Review General Ledger Pending Entries to verify credits and debits are posting to the correct accounts and object codes.

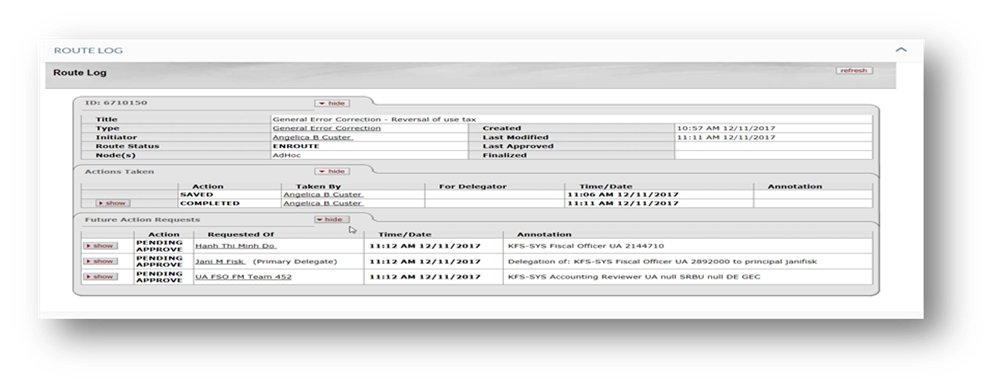

- Click on the Route Log to view the Future Action Requests and next steps

- Click Submit to process the DI